|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Understanding Cash Back from Refinance: Pros and Cons ExploredHomeowners often explore refinancing options to tap into their home equity. One popular method is cash back from refinance, allowing borrowers to access funds for various needs. This article delves into the nuances of this option, weighing its advantages and potential drawbacks. What is Cash Back from Refinance?Cash back from refinance, also known as cash-out refinancing, is when you replace your existing mortgage with a new one that’s larger than what you currently owe. The difference between your new and old mortgage is given to you in cash. How Does It Work?The process involves taking out a new mortgage for more than the amount owed on your existing mortgage and receiving the difference in cash. It’s a way to leverage your home equity for immediate needs. Benefits of Cash Back from Refinance

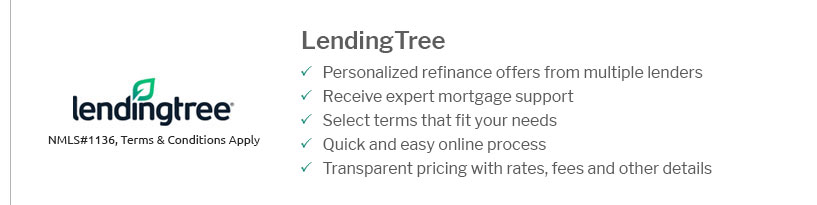

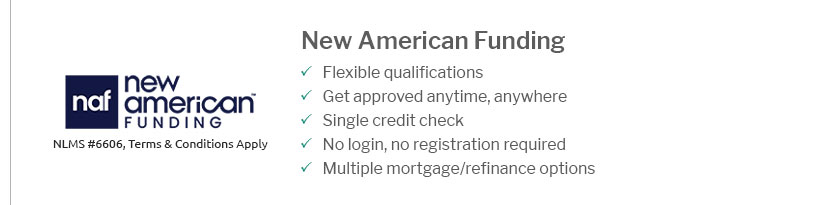

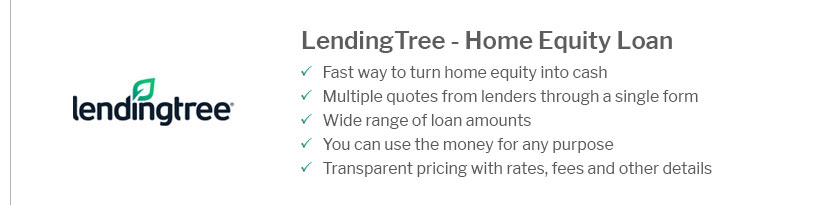

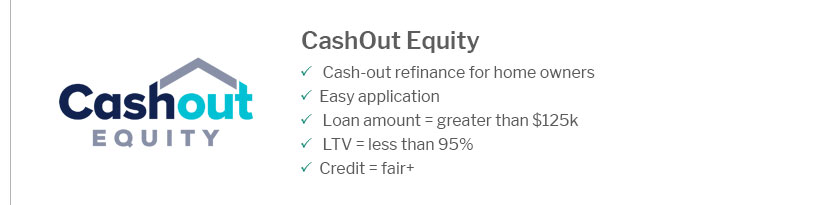

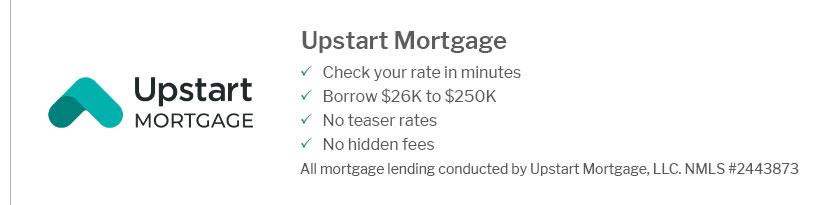

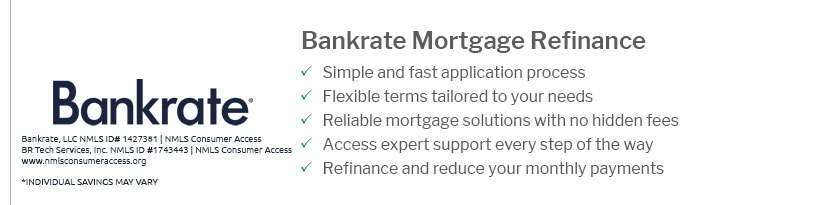

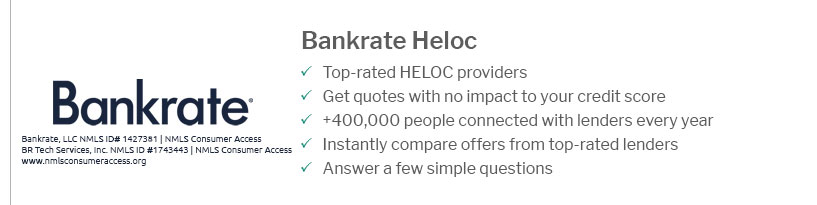

Many reputable home refinance companies offer competitive rates and terms for cash-out refinances. Drawbacks to ConsiderWhile cash-out refinancing can be beneficial, there are potential drawbacks:

It's important to weigh these factors and perhaps explore if a refinance to buy another house might better suit your goals. Frequently Asked QuestionsWhat are the requirements for cash-out refinancing?Typically, you need a good credit score, a low debt-to-income ratio, and significant equity in your home to qualify for a cash-out refinance. Can I use cash-out refinancing for investment purposes?Yes, you can use the funds from a cash-out refinance for various purposes, including investments, provided the lender approves. How long does the cash-out refinancing process take?The process typically takes 30 to 45 days, but it can vary based on the lender and the complexity of the refinance. In conclusion, cash back from refinance is a valuable tool for homeowners needing quick access to funds. By understanding its pros and cons, you can make an informed decision that aligns with your financial objectives. https://selling-guide.fanniemae.com/sel/b2-1.3-02/limited-cash-out-refinance-transactions

Cash Back to the Borrower; Documentation Requirements; Existing Subordinate Liens That Will Not Be Paid Off; New Subordinate Financing; Refinances to Buy Out An ... https://www.lendingtree.com/home/refinance/limited-cash-out-vs-no-cash-out-refinance-whats-the-difference/

A limited cash-out refinance replaces an existing mortgage with a new one, typically at a slightly higher loan amount. This option is popular with borrowers who ... https://www.refijet.com/blogs/cash-back-from-the-equity-in-your-car

This is called a cash-out refinance. You still have to pay off the $16,000 you are borrowing. Yet, new terms mean that you can do that in an affordable way, in ...

|

|---|